Here’s a scenario we’re sure everyone can relate to in some way:

Imagine that you’re completely burnt out from work. Overtime and difficult, involved projects just keep getting thrown your way, and you can feel yourself yearning for some time away. But while spring is coming up where you are, there’s still snow on the ground, and you can still feel a chill from the cold air outside. Plus, you’re broke. So what can you do?

You open up a new tab on your web browser and explore different vacation destinations in places around the world that are currently enjoying their “Summer” months—places with sandy beaches, palm trees, sparkling oceans, and seas. But just as you go to close the tab in frustration, knowing that you simply don’t have the cash for a vacation, something catches your attention: vacation payment plans.

It turns out that some travel providers have caught on to the dilemma that people are facing: they want to go on vacation, and in some cases, need to go on vacation to help repair their mental health, but money is tight, and the idea of a vacation seems out of reach. What vacation payment plans offer would-be travelers is the ability to take a much-needed retreat now and pay later.

Just like you’d put an expensive purchase on a credit card or lease a vehicle, you can now defer paying for your vacation until you’ve got some money saved up. You can also choose to pay for some aspects of your vacation, such as the accommodations and defer the flight so that you don’t have as many payments later. So if you’re feeling like you need to get away, it’s suddenly possible, even if you don’t have all the cash you need upfront.

The idea of pay later travel is still a relatively new concept in the hospitality industry, so this article goes through the basics, including how vacation payment plans work, how you can utilize them as an accommodation provider, and how allowing guests to pay later for their travel can actually help your business from a revenue-generating perspective.

How Do Vacation Payment Plans Work?

The idea behind vacation payment plans is rather simple. Through Expedia, for example, you can choose a vacation package that offers a pay later option. These include accommodation, flights, and more. With some packages, you can pay for some parts of the vacation, such as the flights or the accommodations, and defer the payment for other parts. With Expedia, you can choose the “monthly payment” option at checkout and spread the cost of your vacation over 3, 6, or 12 months using a third-party payment provider like Afterpay, which typically have no interest rates.

What are Point of Sale Loans?

Point of Sale (POS) loans, also known as retail installment loans or buy now, pay later (BNPL) financing, are a type of consumer financing option offered at the point of sale, typically by retailers or online merchants (in this case, it would be through your website or through an OTA) These loans allow customers to spread the cost of their purchases over time, making it easier for them to afford expensive vacations, items, or services without paying the full amount upfront.

Point of Sale loans offer several benefits for both consumers and merchants:

- Convenience: POS loans provide customers with an accessible and convenient financing option directly at the point of purchase, eliminating the need to apply for a separate loan or credit card.

- Affordability: By spreading the cost of their purchases over time, customers can afford to buy expensive items or services without straining their budget.

- Flexibility: POS loans often offer flexible repayment terms and options, allowing customers to choose a plan that best suits their financial situation.

- Increased sales: For merchants, offering POS financing can lead to increased sales and higher order values, as customers are more likely to make purchases when they have access to affordable financing options.

Vacation Payment Plans on OTAs for Accommodation Providers

The way that vacation payment plans work is pretty straightforward for guests, but what about accommodation providers?

Well, there are a few ways that you can get on board with pay later travel for your guests. The first is to simply list your accommodations on an Online Travel Agent (OTA) website that partners with a deferred payment provider like Expedia. The OTA handles all of the behind-the-scenes operations in regard to dealing with the payment provider, so you don’t have to worry about it from your end.

If you want a more direct approach, like giving your guests the option for pay later travel when they book directly through your website, you can partner with a payment provider like Affirm or Afterpay on your own. To do so, you have to negotiate terms with them based on your business type and location. The other way you can accommodate guests who want to take advantage of vacation payment plans is to get a payment and revenue management system like Newbook, where you can set payment terms like frequency, amount, and more and incorporate notifications and reminders so that your guests know when their payments are due.

Accommodating Long-Term Guests With Flexible Payment Plans

In this day and age, it’s essential for accommodation providers of every size to have some sort of revenue management system with comprehensive billing and payment features in place. This piece of software ensures that you can offer your guests many different options when it comes to accepting payments, including being able to accept credit cards, debit, and online payment options like PayPal. In addition, you can better accommodate long-term guests by offering them the ability to pay weekly, monthly, or even yearly, depending on the type of accommodation you offer.

For instance, let’s say that you own an RV park in sunny Palm Springs, California. Your guests are usually snowbirds coming from Canada or other parts of the United States and either have permanent units that they own and park on sites that they rent out or they rent out permanent RVs that you provide on the property. The guests are usually staying for months at a time, so it makes sense that you’d want to offer them the ability to pay monthly or even yearly.

With Newbook, this is an easy setup with the following features:

| Newbook Billing and Account Management Features | Description |

|---|---|

| Flexible payment plan arrangements | Easily offer your guests the ability to pay in installments so that you can capture more bookings and give your guests peace of mind that they can pay over time rather than all at once, especially for longer stays. |

| Automation features save you time and encourage regular payments | Automatically send email invoices and reminders to guests, a notice of late payment fees, and more to make sure that your guests remember to pay on time. This way, you can reduce admin by eliminating the need for someone to send manual reminders to guests or upcoming invoices. |

| Offer your guests the ability to make payments online through a self-service portal | Instead of guests having to call in or wait for someone to be on-site to accept their payment, they can pay online through a self-service payment portal. This also allows guests the flexibility to pay with credit, debit, or an online service like PayPal. |

Integrations to Help Give Guests More Payment Options

Facilitating online payments and Point of Sale (POS) capabilities in Newbook is a smooth and effective procedure. You have various integration options readily available, including:

- Newbook Payments: Integrates EFTPOS terminals, gateways, BPAY, and various other payment methods.

- Clover: Offers smart, customized POS devices for tracking payments and handling guest charges seamlessly.

- Bepoz: Provides a wide range of comprehensive retail POS solutions.

It’s also important to consider accounting integrations to help you manage your business’s revenue better, including where the revenue comes from (e.g., direct bookings, OTA bookings, restaurant sales, gift shop sales, etc.) so you can focus on the sources that make your business the most profit.

Accounting integrations available through Newbook include:

Utilizing accounting tools is crucial for effectively handling all financial aspects of your business. Integrating accounting software with your revenue management system is a logical step to ensure the security and accessibility of financial data. Here are some pre-configured accounting software integrations available with Newbook:

- Attache: A versatile accounting system tailored for medium-sized businesses.

- Infobiz: An online trust accounting system seamlessly compatible with Newbook, offering features such as regulatory compliance, owner access, and local support.

- MYOB: Provides efficient payment reconciliation, payroll, and accounting management, among other features.

- Ozbiz Solutions: Connects with software like Attache, MYOB, or Reckon to Newbook, enabling real-time financial data management.

- Quickbooks: Integration with Newbook allows for automatic daily transaction transfers to Quickbooks, streamlining account reconciliation processes.

- Reckon: A robust software solution facilitating finance, payroll, and inventory management.

Pay Later Travel: Go on Vacation Now and Pay Later

The desire to travel and explore new destinations remains as strong as ever. However, the cost associated with planning a vacation can often be a barrier for many individuals and families. Imagine if your best friend announces that they want to do a destination wedding, but you don’t have the cash to travel to Mexico. Or your family contacts you from out of state to tell you that your grandmother isn’t doing too well, but you don’t have the funds to pay for a flight to your home state to be with her at the hospital before she passes.

This is where the concept of pay later travel comes into play, offering a convenient and flexible solution for those who want to enjoy their dream getaway, attend that destination wedding, or be with their family when they need to without the immediate financial burden.

Pay later travel allows individuals to book and enjoy their vacation experiences upfront while deferring the payment for a later date. Instead of paying the full cost of the trip upfront, travelers can spread out their payments over time, making it easier to manage their finances and budget effectively. But what are the reasons behind the increasing popularity of pay later travel options?

- Financial flexibility: One of the primary reasons why people choose to defer payment for their vacation is the financial flexibility it provides. By spreading out the cost of their trip over several installments, travelers can avoid putting a strain on their finances and instead enjoy the freedom to explore new destinations without worrying about immediate payment obligations.

- Budget management: Planning a vacation often involves significant upfront costs, including flights, accommodations, and activities. For many people, paying for these expenses all at once can disrupt their monthly budget and lead to financial stress. Pay later travel allows individuals to break down the cost of their trip into more manageable payments, making it easier to stay within their budget and avoid overspending.

- Opportunity to travel sooner: Deferred payment options enable travelers to book their vacation experiences well in advance, even if they don’t have the funds available upfront. This means that they can take advantage of early booking discounts, secure desirable accommodations, and plan their itinerary with peace of mind, knowing that they have the flexibility to pay for their trip over time.

- Emergency preparedness: Life is unpredictable, and unexpected expenses can arise at any time. By choosing pay later travel options, individuals can preserve their savings for emergencies while still being able to enjoy their vacation experiences. This added financial security provides peace of mind and ensures that travelers are prepared for any unforeseen circumstances that may arise.

- Enhanced travel experience: Finally, pay later travel allows individuals to enjoy a more enriching and fulfilling travel experience. By spreading out the cost of their trip, travelers can afford to indulge in premium accommodations, unique activities, and immersive cultural experiences that they may not have been able to afford otherwise. This enables them to create lasting memories and make the most of their time away.

Why You Should Consider Setting Up a Book Now, Pay Later Option

Between inflation, rising costs of pretty much everything from food to real estate, and people increasingly being under financial pressure, you’d think that there would be fewer people interested in traveling. However, a recent survey from Expedia shows otherwise: of the 11,000 consumers and 1,100 industry professionals surveyed, nearly half (46%) indicated that they find travel more important to them than before the pandemic—perhaps the isolation made them realize the importance of being able to get away.

At the same time, 43% of respondents indicated that they plan to increase their travel budget, while a significant 79% are planning to go on at least a leisure trip (likely camping or a few nights stay somewhere close to home). This is likely because a leisure trip still lets you get away from it all, but it’s usually much less expensive than flying somewhere.

When it comes to price, of course, that’s a big deal for both consumers and professionals when it comes to booking travel. Expedia’s most recent Traveler Value Index report indicates that:

- Atypical, low pricing is the most important factor affecting whether they will book with a provider or not.

- The ability to get a full refund is also important, being the next biggest factor that affects a successful booking.

- After the pandemic, people want to have peace of mind that they are safe. When accommodation providers indicate that they use more robust cleaning procedures, they are able to secure more bookings.

- Flexibility with bookings is also key. Being able to change booking dates or details without additional fees and penalties is important for guests.

- Of course, people still want access to the luxuries on their trip. Guests will look for the availability of premium and first-class upgrades before booking.

- Self-service, contactless experiences are becoming more popular, and guests are looking for accommodations that offer those experiences as a result. Self-service options give the guest more direct control over their vacation experience.

- Sustainability and the environment are front of mind for most people, especially with climate change. People want to do their part by choosing accommodations that take action to be more sustainable and environmentally friendly, whether that’s through going paperless, providing reusable products (such as cutlery, cups, and more), or promoting sustainable practices.

Even though there are many different factors that go into whether or not a guest chooses to book with you or not, price remains the biggest factor. Book now pay later hotels have the advantage of being able to offer guests more options to pay, even if that means deferring the entire cost of their trip. The table below summarizes the benefits of offering vacation payment plans:

| Buy Now Pay Later Travel Benefit | Description |

|---|---|

| Helps attract more guests | By offering BNPL options, accommodation providers can attract a larger pool of potential guests who may not have the upfront funds to pay for their stay in full. This expanded customer base can lead to increased bookings and higher occupancy rates, especially during peak travel seasons. |

| Can help bridge the revenue gap during the low season | BNPL arrangements allow accommodation providers to receive payment for bookings upfront, even if guests choose to defer their payments over time. This steady stream of revenue can help improve cash flow and provide financial stability for providers, especially during slower periods or the off-season. |

| Allows for greater upsell opportunities | BNPL options can also create opportunities for accommodation providers to utilize upsell software to offer additional services and amenities to guests during the booking process. By promoting add-ons such as room upgrades, spa treatments, or dining packages at the time of booking, providers can increase their revenue per guest and maximize the value of each booking. |

| Greater competitive advantage | In today’s competitive travel industry, offering BNPL options can set accommodation providers apart from their competitors. By providing flexible payment solutions that cater to the needs of modern travelers, providers can differentiate their offerings and attract travelers who value convenience and flexibility. |

| Access to new markets | BNPL options can make travel more accessible to a wider range of travelers, including those who may have limited access to traditional financing options or credit cards. By catering to these underserved markets, accommodation providers can tap into new customer segments and expand their customer base. |

Conclusion

Vacation payment plans have opened up new avenues for both travelers and accommodation providers. For travelers, these flexible payment plans offer the freedom to enjoy their dream vacations without immediate financial strain. For accommodation providers, embracing BNPL options can lead to increased bookings, improved cash flow, and greater competitiveness in the market.

By offering travelers the ability to pay later for their travel experiences, accommodation providers can:

- Attract a larger customer base

- Bridge revenue gaps during slower periods

- Capitalize on upsell opportunities

- Stay competitive

BNPL options also enable providers to tap into new markets and meet the evolving needs of modern travelers, ultimately driving their business’s growth and success in the hospitality industry.

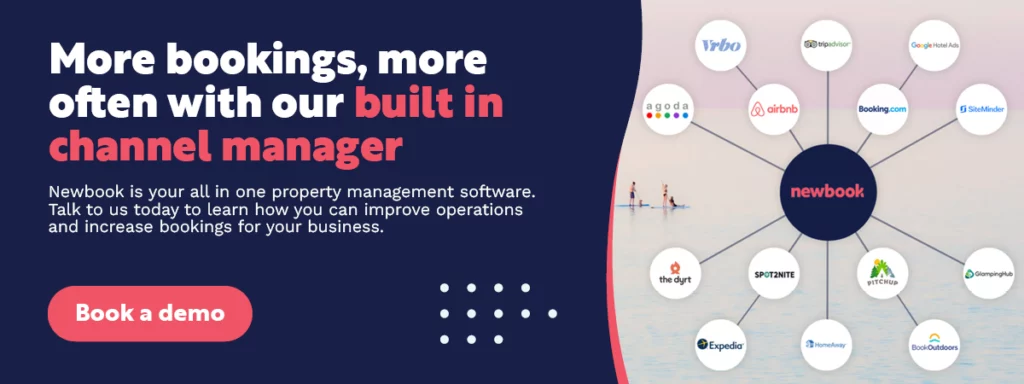

To effectively manage your revenue, guest information, booking information, OTAs that you list with, and the finer details of your business, it’s important to invest in a property management system that combines revenue management, guest management, and OTA management in one comprehensive solution.

Reach out to Newbook today to learn more about how our software can improve your business.